Table of Content

Besides a fixed monthly value, on-line payroll companies often charge per transaction or employee fee. This implies that the bigger the variety of employees, the higher the transaction fee. If you would possibly be planning to increase your workforce, rigorously contemplate how your payroll service price will change when you are growing. Most payroll providers have a tiered cost construction to cater to businesses of different sizes.

That’s why we chose ADP Run as our best payroll service for growing businesses, significantly these planning to develop to greater than a hundred staff. Even though some Gusto customers praise the easy-to-navigate interface and breadth of providers, others note that customer service isn't at all times responsive to help requests. Some third-party customer evaluations even notice that they had been left with balances from the Internal Revenue Service although Gusto claims it handles taxes. Each takes away the fear about whether you’re doing payroll correctly and helps you deal with payroll without a big staff to complete the work. SurePayroll doesn’t publish their costs on-line, however they do supply one free month of service.

What Features Should A Payroll Service For Small Businesses Have?

All Paychex payroll programs include new-hire state reporting, payroll tax filing, and an employee financial wellness program. And with three customizable packages, Paychex is doubtless one of the most scalable payroll options on our list. Growing businesses won’t have to look elsewhere for plans that help further employees—growth is constructed into Paychex’s model. The finest payroll supplier for your company is dependent upon your corporation measurement and wishes. ADP RUN presents tiered plans with payroll by direct deposit, a self-service worker platform, new hire onboarding and optional advantages administration for extra charges. You can use the OnPay software program to add workers to your payroll, set statuses, run payroll and handle paid day with out work .

ADP’s payroll for corporations with lower than 10 workers permits you to set up an account in simply 20 minutes. In addition to payroll, they offer help on bills, on demand fee, tax and wage garnishment. They present nice onboarding help – so your new hires are arrange and ready-to-go rapidly. QuickBooks Payroll additionally provides a fantastic reporting feature – so you presumably can evaluate time and attendance and staffing costs in an intuitive way.

Find The Best Online Payroll Service For Your Business

It comes to the platform together with accounting, invoicing and cost processing for small businesses—replacing a laundry list of tools for many entrepreneurs. Gusto is the world-leading payroll software that helps companies get paid on time and in full, file taxes as effectively as potential, and have a extra wholesome workplace. A good payroll provider should have a platform that is simple to use, has loads of options, is reliable, reliable and has great customer support. Gusto is a highly recommended payroll platform used by more than 60,000 businesses around the globe. Among its host of many payroll capabilities are automated taxes, compliance management, and multi-state payroll tools.

The firm engages yours in a co-employment relationship—i.e., it’s an employer of report for your employees—so it may possibly handle HR and payroll in your behalf. Gusto consists of options which may enchantment particularly to trendy startup staff, together with automated charitable donations and a wallet that provides staff larger management of and entry to their money. Zoho Books is a web-based accounting system that mixes conventional bookkeeping practices with modern technologies. It features instruments to manage gross sales, inventory, customers, distributors and staff.

Can Payroll Service Suppliers Handle My Tax Reporting?

Most of the options in the more expensive plans are available as an add-on possibility, with pricing out there instantly from Paychex Flex. You’ll also pay more should you add additional features, corresponding to Time and Attendance, HR, and Employee Benefits Administration. Paychex Go, designed for up to 10 employees, begins at $59/month, with a $4 payment per worker assessed as properly.

Wave Payroll costs from $35/month plus $6/employee/month and presents a 30-day free trial. Wave Payroll helps you arrange direct deposits and permits you to know if certainly one of your funds failed. QuickBooks Payroll prices from $22.50 per month plus $5/employee/month and offers a 30-day free trial. Gusto costs from $40/month plus $6/user/month and offers a free demo. Users can run payroll in three straightforward steps and monitor the fee status of workers with PrimePay.

Choosing the best payroll corporations for small enterprise could be difficult, as there are such a lot of to select from. However, there are some key steps you should follow to ensure that you make the proper decision. If you wish to start using a payroll software program, however don’t know tips on how to find the most effective one in your needs, this text shall be helpful. Features include online banking integration, automated invoice creation, stock administration, point-of-sale and barcode scanning technology, project management and extra.

If you may have more than 10 workers, you’ll need to request a quote from Paycor. Optional Time and Attendance and HR modules are additionally obtainable, each integrating with the payroll software. All accounts begin with a 7-day free trial and can be cancelled at any time. Sage University presents you the ideas and methods to use the software program like a pro. Small enterprise house owners are multi-taskers – with a number of duties on their plate.

Gusto is fairly priced, offering a broad range of worth plans between $40.00 per 30 days + $6.00 per employee to $80.00 per 30 days + $12.00 per worker. Finally, you want to look into what sort of customer support the company provides. How is the payroll provider rated by the Better Business Bureau, and what quantity of customer complaints are there? Is there phone, email and chat help, or are you restricted to simply one of those options?

PEOs like TriNet are an excellent fit for small companies with complex hiring and potential business liability—for example, when you hire international employees or have a lot of turnover. PEOs like Justworks are a good match for small businesses with complicated hiring and potential business liability—for example, if you hire worldwide employees or have lots of turnover. Keep in mind, nonetheless, that there are numerous other components that decide which payroll provider is best for you. Compare your finances with the pricing of each service supplier and ensure it matches inside your price range. Accounts may be arrange in a couple of minutes and transactions could be initiated from anywhere using an internet browser.

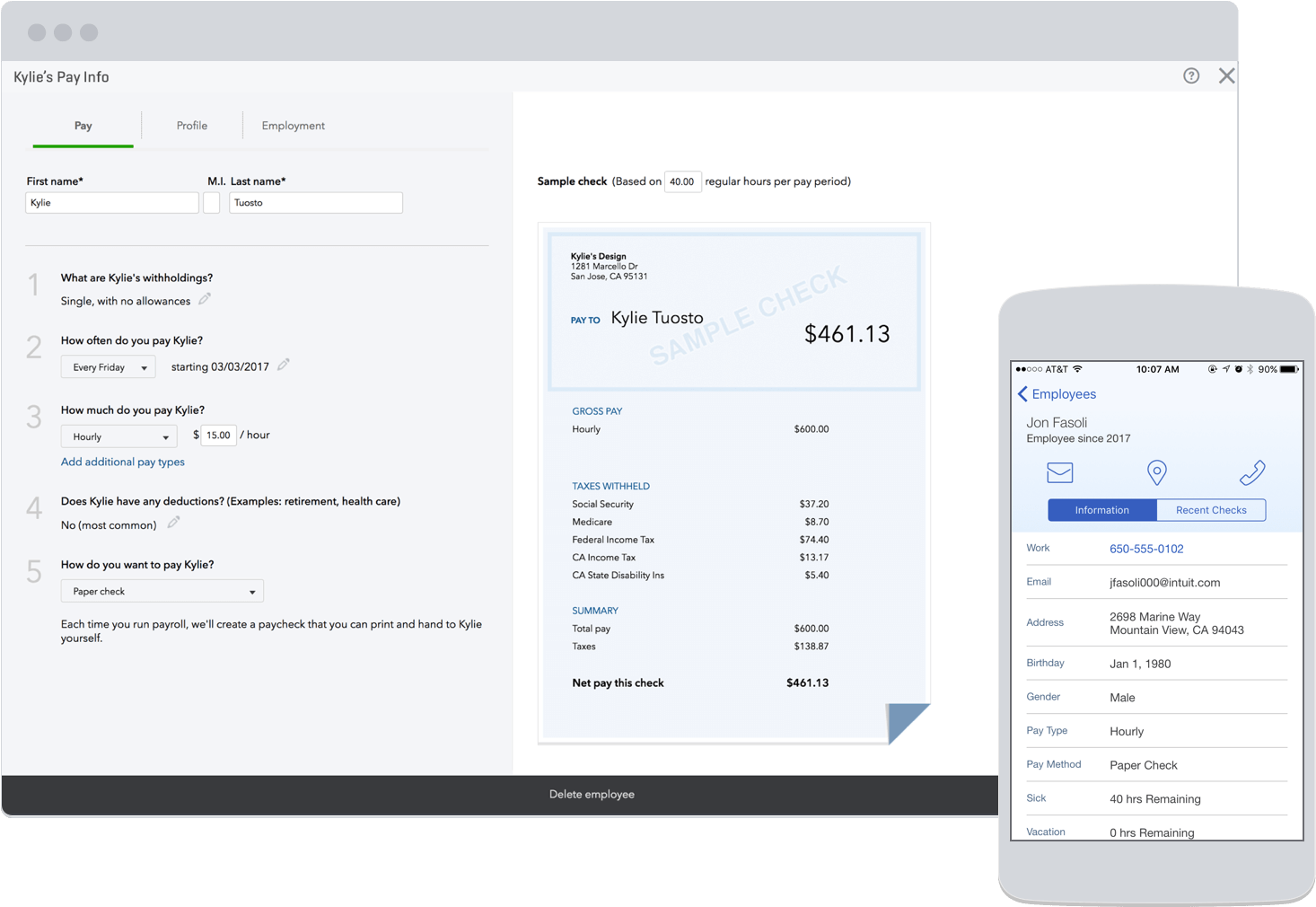

With this kind of software, you'll enter your employees' data, such as salary fee and tax status, and a few business particulars, similar to your company's pay schedule. QuickBooks Payroll’s interface has subsequent to no studying curve, and its well-reviewed employer-facing cell app makes on-the-go payroll simpler. You are responsible for operating payroll each pay period as soon as you convey on a single worker. And generally the extra workers you bring on board, the more complicated the process can turn into. That’s why it’s so useful to have leading online payroll services for small enterprise that can scale with your group.

No comments:

Post a Comment